In today’s fast-paced financial markets, traders are always looking for the best tools to maximize their potential earnings. FxPro, a globally recognized forex and CFD trading platform, offers advanced features to help traders make informed decisions based on past market movements. Whether you’re a beginner or a seasoned trader, understanding historical trends can significantly enhance your trading strategies.

In today’s fast-paced financial markets, traders are always looking for the best tools to maximize their potential earnings. FxPro, a globally recognized forex and CFD trading platform, offers advanced features to help traders make informed decisions based on past market movements. Whether you’re a beginner or a seasoned trader, understanding historical trends can significantly enhance your trading strategies.

Why Choose FxPro for Trading?

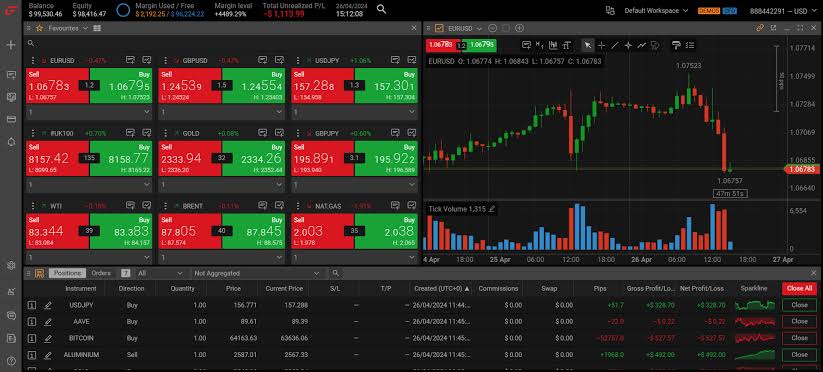

FxPro has established itself as a reliable broker, providing traders with access to multiple asset classes, including forex, stocks, commodities, indices, and cryptocurrencies. The platform is known for its tight spreads, lightning-fast execution, and user-friendly interface. With advanced trading tools and a secure environment, FxPro caters to both retail and institutional traders worldwide.

Key Features of FxPro:

✅ Multiple Trading Platforms – Choose from MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, and FxPro Edge.

✅ Low Latency Execution – Orders are executed in milliseconds, ensuring minimal slippage.

✅ Advanced Market Analysis – Use historical data to refine your strategies.

✅ Negative Balance Protection – Ensures that traders don’t lose more than their deposited funds.

✅ Flexible Leverage – Adjust your risk level according to your trading strategy.

Analyzing Past Market Movements to Improve Future Trades

One of the most powerful features of FxPro is its ability to analyze past market movements, helping traders identify trends and predict future price actions. Here’s how you can leverage historical market data for better trading decisions:

1. Identify Key Support and Resistance Levels

By analyzing past price movements, traders can determine crucial support and resistance levels. These levels indicate where the price has historically struggled to move beyond, helping traders decide on entry and exit points.

2. Recognize Repeating Market Patterns

Historical price movements often form recognizable chart patterns like head and shoulders, double tops/bottoms, and triangles. These patterns can indicate potential price direction changes, allowing traders to capitalize on predictable movements.

3. Utilize Technical Indicators

FxPro provides access to numerous technical indicators, such as moving averages, MACD, RSI, and Bollinger Bands. Analyzing historical trends using these indicators can improve accuracy in forecasting price movements.

4. Backtest Trading Strategies

With FxPro’s powerful backtesting tools, traders can test their strategies on past market data before applying them to live markets. This helps in refining strategies without risking real capital.

How to Get Started with FxPro

Getting started with FxPro is simple:

🔹 Register for a Free Account – Sign up on the official FxPro website.

🔹 Practice with a Demo Account – Use virtual funds to test strategies before trading with real money.

🔹 Choose Your Preferred Trading Platform – Select from MT4, MT5, cTrader, or FxPro Edge.

🔹 Fund Your Account Securely – Deposit funds using bank transfers, credit cards, or e-wallets.

🔹 Start Trading & Monitor the Markets – Use FxPro’s advanced tools to track market movements and refine your trading strategies.

Conclusion

FxPro is a top choice for traders looking to maximize their earnings by leveraging historical market movements. By using advanced charting tools, backtesting features, and a secure trading environment, traders can enhance their decision-making and increase their profitability.

Whether you’re new to trading or an experienced investor, FxPro provides the necessary tools to help you navigate the markets confidently. Sign up today and take advantage of FxPro’s powerful trading platform to unlock your full trading potential!

Would you like me to include real-life case studies of market movements or trading success stories? Let me know how I can refine the article!